Effective strategies to discuss in-game purchases with kids and prevent overspending?

Navigating the World of In-Game Purchases with Your Children

In today’s digital landscape, video games often come with more than just entertainment; they present a complex ecosystem of in-game purchases, ranging from cosmetic upgrades to performance-enhancing items. For parents, this can be a minefield, leading to unexpected charges, arguments, and the potential for overspending. The key to managing this isn’t just prohibition, but rather fostering open communication and teaching responsible financial habits. Let’s explore effective strategies to discuss in-game purchases with your kids and prevent financial surprises.

Why Open Dialogue is Crucial

Simply saying “no” to all in-game purchases might seem like the easiest solution, but it misses an opportunity for valuable life lessons. Discussing these purchases helps children understand money management, the concept of value, and the difference between wants and needs. It also builds trust, showing your child that you respect their interests while guiding them toward responsible choices. Ignoring the issue can lead to secret purchases, frustration, and a lack of understanding about real-world financial implications.

Strategy 1: Establish Clear Rules and Budgets

Before any in-game spending occurs, sit down with your child to establish clear, mutually understood rules. This might involve:

- A Fixed Allowance for Gaming: Provide a weekly or monthly budget specifically for in-game purchases. Once it’s gone, it’s gone.

- “Ask First” Policy: Mandate that all purchases, regardless of price, require parental approval. This allows for discussion about the item’s value and necessity.

- Earning Opportunities: Connect larger in-game purchases to chores or academic achievements, teaching them the value of earning.

Document these rules and display them if necessary, ensuring there’s no ambiguity.

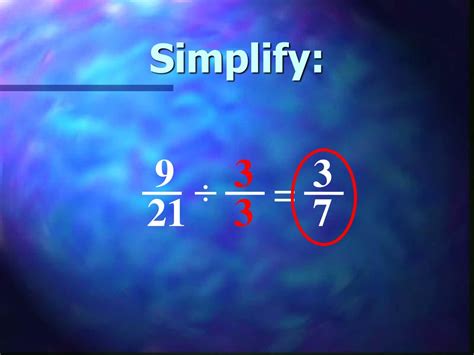

Strategy 2: Educate on Real-World Value vs. Virtual Currency

Many games use virtual currencies (gems, V-bucks, coins) that abstract the real monetary cost. Help your child connect these virtual units back to actual dollars and cents. For example, explain that “100 V-bucks cost about $1” so they can grasp the true price of that new skin or dance emote. Discuss the concept of impulse buying and how marketers design games to encourage spending.

Strategy 3: Utilize Parental Controls and Password Protection

Technology offers tools to support your established rules. Most gaming platforms (PlayStation, Xbox, Nintendo, PC storefronts, mobile app stores) have robust parental control settings that allow you to:

- Require a password for every purchase.

- Set spending limits.

- Block purchases entirely.

Implement these controls strictly. Make sure your child understands why these measures are in place – they are safeguards, not punishments.

Strategy 4: Lead by Example and Involve Them in Family Finances

Children learn by observing. Be mindful of your own spending habits, both online and offline. Talk about family budgeting, saving for larger purchases, and distinguishing between needs and wants. When your child understands how family money is managed, they are more likely to apply similar principles to their own spending, including in-game purchases.

Fostering Financial Literacy in a Digital Age

Addressing in-game purchases is more than just protecting your wallet; it’s about instilling essential financial literacy skills in your children. By engaging in open, honest discussions, setting clear boundaries, and utilizing available tools, you can transform a potential source of conflict into an opportunity for growth. Empower your kids to be responsible digital consumers, understanding the value of money and making thoughtful spending decisions both within and outside their favorite virtual worlds.