What’s the key to fast, accurate deal valuation?

The Imperative of Precision and Speed in Deal Valuation

In the high-stakes world of mergers and acquisitions (M&A), the ability to accurately and rapidly value a potential deal is paramount. It’s not merely about putting a number on an asset; it’s about understanding its true potential, assessing risks, and making informed decisions that drive shareholder value. Delays can mean lost opportunities, while inaccuracies can lead to disastrous overpayments or missed bargains. So, what truly unlocks the dual benefits of speed and accuracy in this critical process?

Robust Data & Advanced Analytics: The Foundation

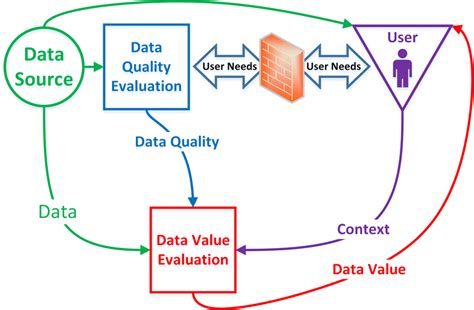

At the core of any sound valuation lies high-quality data. Fast and accurate deal valuation demands access to comprehensive, reliable, and up-to-date financial, operational, and market data. This isn’t just about collecting information; it’s about efficiently cleansing, structuring, and analyzing it. Advanced data analytics tools, including AI and machine learning, are becoming indispensable, sifting through vast datasets to identify patterns, anomalies, and critical drivers that human analysts might miss.

These tools can accelerate the initial data gathering and due diligence phases, providing a clearer picture of the target’s financial health and operational efficiency much faster than traditional methods. The move from manual data entry to automated aggregation and validation significantly reduces errors and frees up valuable time for strategic analysis.

Sophisticated Financial Modeling & Scenario Planning

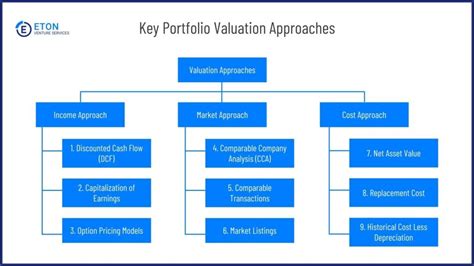

Beyond raw data, the ability to build and manipulate sophisticated financial models quickly and flexibly is crucial. Discounted Cash Flow (DCF), comparable company analysis (CCA), and precedent transaction analysis (PTA) remain staples, but the speed comes from the agility with which these models can be adjusted for various assumptions and scenarios. Modern valuation platforms allow for real-time adjustments, sensitivity analyses, and stress testing, enabling dealmakers to understand the valuation impact of different market conditions, synergy assumptions, and operational changes instantly.

This dynamic modeling capability allows teams to explore multiple ‘what-if’ scenarios, providing a comprehensive understanding of the valuation range and the key value drivers, rather than relying on a single, static point estimate. It transforms valuation from a laborious calculation into an interactive, strategic exploration.

Streamlined Processes and Collaborative Platforms

Even with the best data and models, a lack of seamless collaboration can derail speed and introduce errors. Effective deal valuation requires cross-functional input from finance, legal, operational, and market experts. Centralized, secure collaboration platforms – such as virtual data rooms (VDRs) with integrated analytical tools – are vital for sharing information, tracking progress, and ensuring all stakeholders are working with the latest data and assumptions.

Standardized workflows and clear communication channels minimize redundant efforts, prevent miscommunications, and ensure that all pieces of the valuation puzzle come together efficiently. This holistic approach ensures that the valuation reflects a complete understanding of the target from every angle, not just the financial.

The Indispensable Role of Expert Insight and Experience

While technology and processes provide the infrastructure, human expertise remains irreplaceable. Experienced dealmakers and valuation specialists bring nuanced judgment, industry knowledge, and an understanding of market dynamics that algorithms alone cannot fully replicate. They interpret the data, challenge assumptions, identify qualitative factors, and apply strategic thinking to the numbers.

Their ability to spot red flags, understand the competitive landscape, and assess the qualitative aspects of a target (e.g., management team quality, brand reputation, intellectual property) adds a layer of accuracy and context that is critical for a truly robust valuation. This blend of technological prowess and seasoned judgment is what differentiates merely fast from truly accurate.

Conclusion: A Synergistic Approach

Ultimately, the key to fast, accurate deal valuation is not found in a single tool or method, but in a synergistic combination of all these elements. It requires:

- High-quality, accessible data powered by advanced analytics.

- Flexible, sophisticated financial modeling for dynamic scenario planning.

- Streamlined, collaborative processes supported by integrated platforms.

- Seasoned expert insight to interpret, challenge, and contextualize.

By integrating these components, firms can move beyond reactive valuation to proactive, strategic assessment, gaining a significant competitive edge in the fast-paced M&A landscape. This comprehensive approach ensures that decisions are not only made quickly but with the highest degree of confidence, driving successful deal outcomes and sustainable growth.