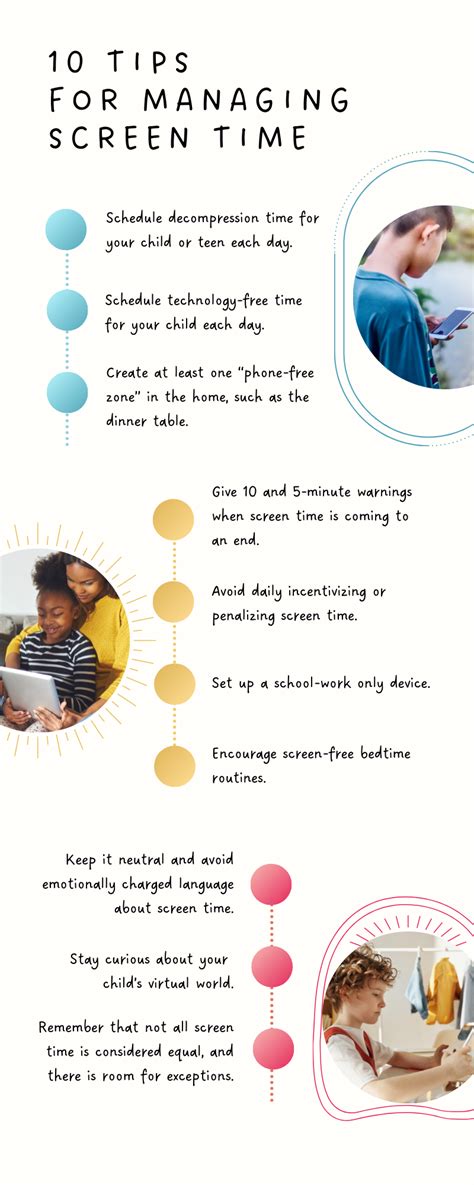

F2P Gacha: How to avoid overspending, manage FOMO, and maximize long-term fun?

This article provides practical strategies for free-to-play gacha game enthusiasts to avoid common pitfalls like overspending and fear of missing out, ensuring a sustainable and enjoyable gaming experience over the long term.