Key red flags in due diligence for deal-making?

Due diligence is the bedrock of successful deal-making, providing a critical lens through which potential investors and acquirers can scrutinize a target company. Far from being a mere formality, a thorough due diligence process unearths the hidden truths and potential pitfalls that could derail an otherwise promising transaction. Identifying red flags early is not just about negotiating a better price; it’s about protecting an investment, mitigating future risks, and ensuring long-term value creation. Ignoring these warning signs can lead to costly post-acquisition headaches, legal battles, and even complete deal failure.

Financial Irregularities and Performance Concerns

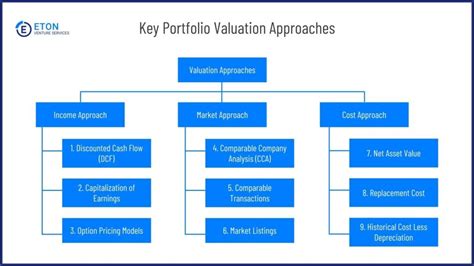

Perhaps the most immediate and often revealing red flags surface in the financial review. Inconsistent financial statements, a sudden change in accounting policies, or a lack of detailed financial records should immediately raise an eyebrow. Scrutinize declining revenue trends, especially if masked by one-off gains, or unusually high customer concentration which makes the target vulnerable to a single client’s departure. Watch out for unusually aggressive revenue recognition practices, unexplained fluctuations in profit margins, or significant off-balance-sheet liabilities. Furthermore, a heavy reliance on short-term debt, an unsustainable burn rate, or a history of missed financial projections can signal deeper operational issues.

Legal, Regulatory, and Compliance Hurdles

Legal and regulatory due diligence can uncover a minefield of potential liabilities. Active or pending litigation, especially class-action lawsuits or regulatory investigations, poses a significant threat to a deal’s valuation and future operations. Intellectual property (IP) issues, such as unregistered trademarks, expiring patents, or disputes over ownership of key technologies, can severely undermine a company’s competitive advantage. Non-compliance with environmental regulations, data privacy laws (like GDPR or CCPA), or industry-specific mandates can result in hefty fines and reputational damage. A history of regulatory breaches, even minor ones, could indicate a systemic lack of internal controls and a higher risk profile.

Operational Inefficiencies and Key Personnel Risks

Beyond the numbers and legal documents, operational due diligence delves into how the business actually runs. Red flags here might include an aging technology infrastructure that requires substantial capital investment, or inefficient operational processes leading to high costs and low productivity. High employee turnover, particularly among key management or technical staff, can signal a toxic work culture or an over-reliance on a few critical individuals whose departure could cripple the business. A weak or undiversified supply chain, with dependence on a single supplier for critical components, exposes the company to significant disruption risks. Lack of clear succession planning or inadequate documentation of core processes can also be serious concerns.

Market Position and Commercial Viability

Understanding the target’s market and competitive landscape is vital. A shrinking market share, intense competition, or a lack of clear competitive differentiation are significant commercial red flags. Be wary of businesses that operate in a niche market with limited growth potential or those heavily reliant on a single product or service line. Customer concentration, where a large percentage of revenue comes from a few clients, makes the business highly vulnerable if those relationships sour. Furthermore, if the target’s business model is easily replicable or faces disruptive technological changes, its long-term viability might be questionable.

Cultural Misfits and Integration Challenges

Often overlooked, but critically important, are the cultural aspects of an acquisition. A significant mismatch between the acquiring and target company cultures can lead to post-merger integration nightmares, decreased productivity, and the loss of key talent. Resistance to change from target employees, a lack of transparency from management during due diligence, or a history of internal conflicts can all signal potential integration challenges. Assessing leadership alignment and employee morale is crucial, as a disgruntled workforce can quickly undermine any synergy projections.

Conclusion: The Prudence of Walking Away

Identifying red flags during due diligence is not about finding a perfect company—no such entity exists. Instead, it’s about understanding and quantifying the risks involved and determining if they are manageable, priced appropriately, or simply too great to bear. A thorough and unbiased due diligence process empowers buyers with the knowledge to make informed decisions. Sometimes, the most prudent decision, despite significant investment of time and resources, is to walk away from a deal that presents too many intractable red flags. Protecting capital and strategic objectives always outweighs the pressure to close a potentially flawed transaction.