Key red flags in due diligence for deal-making?

Identifying critical red flags during due diligence is paramount for investors and acquirers to mitigate risks and ensure the long-term success of any deal.

Identifying critical red flags during due diligence is paramount for investors and acquirers to mitigate risks and ensure the long-term success of any deal.

Identifying the single most effective qualifying question can dramatically reduce wasted sales efforts by pinpointing genuine opportunities with urgency and clear business impact.

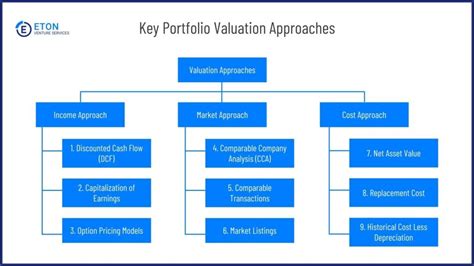

Achieving fast and accurate deal valuation hinges on a synergistic blend of robust data, advanced analytics, streamlined processes, and expert insight, enabling confident decision-making in competitive markets.

Discover effective strategies to initiate deal negotiations with confidence, setting a fair and justifiable offer that avoids lowballing and fosters a productive discussion.

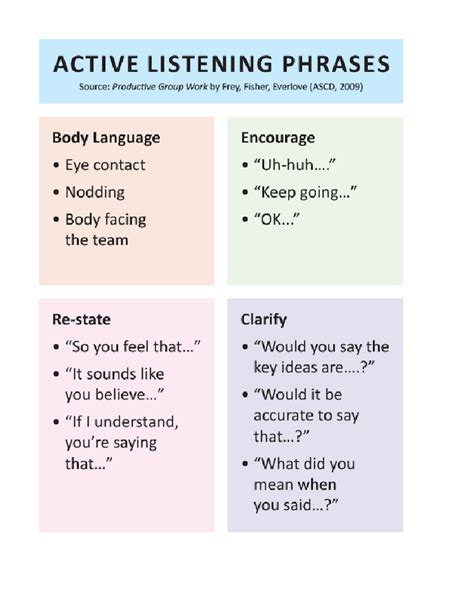

When a promising deal grinds to a halt, the best tactic often involves a strategic re-evaluation, identifying the true blockage, and providing renewed value or urgency to reignite the conversation.

Learn effective, value-driven strategies to create a compelling sense of urgency in your sales processes, encouraging prospects to commit faster without resorting to price reductions.