Actionable advice for managing kids’ in-game purchases and microtransactions?

The digital playgrounds of today’s children are often filled with enticing in-game purchases and microtransactions, from cosmetic skins to power-ups that promise an edge. While these elements are integral to many popular games, they can quickly lead to unexpected costs and parental frustration if not properly managed. Understanding how to navigate this landscape is crucial for protecting your wallet and teaching your children valuable lessons about money and digital consumption.

Establishing Open Communication and Education

The first step in managing in-game purchases isn’t about setting up technical blocks; it’s about dialogue. Talk to your children about how free-to-play games make money and the concept of microtransactions. Explain that real money is involved, even if it feels like virtual currency. Discuss wants versus needs, and the value of saving. This foundational understanding helps them make more informed decisions.

- Explain the business model behind free games.

- Discuss the difference between virtual and real money.

- Help them understand the concept of value and delayed gratification.

Setting Clear Boundaries and Rules

Once the conversation is open, establish concrete rules. This might include a strict “no purchases without permission” policy, a monthly spending allowance for games, or only allowing purchases for special occasions. Involve your child in setting these rules where appropriate, making them more likely to adhere to them. Clearly define what constitutes a “purchase” – whether it’s an item, a currency pack, or a battle pass.

Consider creating a family gaming budget. This isn’t just about limiting spending; it’s about teaching budgeting skills. If they have a set amount for games each month, they learn to prioritize what they truly want.

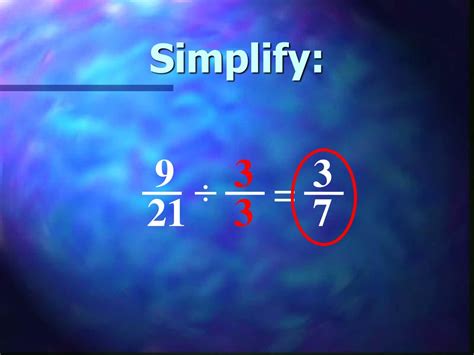

Leveraging Parental Controls and Security Settings

Almost every gaming platform, console, and mobile app store offers robust parental control features designed to restrict or require approval for purchases. Take the time to explore and configure these settings:

- Console Controls: PlayStation, Xbox, and Nintendo Switch all have family accounts that allow parents to set spending limits, require passwords for purchases, or disable purchasing entirely.

- Mobile App Stores: Apple’s App Store and Google Play Store offer similar options, allowing parents to approve purchases through family sharing features or require a password/biometric scan for every transaction.

- PC Game Stores: Platforms like Steam also have family view options to control access and spending.

Crucially, never save your credit card details directly to your child’s device or game account without purchase approval safeguards in place. It’s often safer to use gift cards with fixed amounts for purchases you approve, or set up a dedicated virtual card with a low limit.

Implementing Alternative Earning and Spending Systems

Empower your children to “earn” their in-game purchases. This can be tied to chores, good grades, or other responsibilities, turning discretionary spending into a reward for effort. This system not only manages immediate costs but also reinforces the connection between work and reward, a fundamental financial concept.

Alternatively, consider a “virtual allowance” where they receive a set amount of virtual currency or real money for in-game spending each month. This gives them autonomy within defined limits and allows them to practice managing their own budget.

Regular Monitoring and Review

Managing in-game purchases is not a one-time setup; it’s an ongoing process. Regularly check purchase histories on accounts, and periodically review your parental control settings to ensure they are still effective and haven’t been circumvented. As your children grow, their understanding of money and gaming evolves, and your approach may need to adapt.

Use any unexpected purchases as teaching moments rather than simply reacting with anger. Discuss why the purchase was made, if it was worth it, and how to prevent similar situations in the future. This iterative process strengthens their financial literacy over time.

Conclusion

Navigating the world of kids’ in-game purchases and microtransactions requires a blend of clear communication, technological safeguards, and a thoughtful approach to financial education. By proactively setting boundaries, utilizing available tools, and fostering an understanding of money, parents can transform potential pitfalls into valuable opportunities for teaching responsibility and smart digital consumption. Remember, the goal isn’t just to stop spending, but to cultivate a generation of financially savvy gamers.